Ethereum Activation Queue: What Goes Up Must Come Down.

A brief analysis of the ETH staking bottleneck.

Intro

Following the Ethereum Shapella upgrade which enabled withdrawals on April 12, 2023, both retail and institutional capital that had been awaiting its successful completion began to flow into ETH staking. However, the influx of staking quickly surpassed the protocol churn limit for activation, resulting in a lengthy activation queue that currently stands at 44 days. This prolonged queue is impeding the growth of new ETH staking protocols. However, the churn limit is designed to gradually expand over time, and coupled with a decrease in the rate of ETH staking, I predict that the activation queue will only persist for several more months.

Churn Limit

The churn limit acts a governor in the Ethereum validator staking system, limiting the speed of change among the validator set.

The reason for the entrance/exit queue limits is to ensure that the validator set cannot change too quickly between any two points in time, which ensures that finality guarantees still remain between two chains as long as a validator logs on often enough.

-Vitalik Buterin1

The churn limit expands along with the increase in validators. For every 65,536 validators on the Ethereum network, the number of new validators that can be activated/exited per epoch increases by one.

As of today July 4th, 2023 there are 88,829 validators in the activation queue with a current wait time of 44 days. With 647,930 active validators, in a couple days we will reach the next step change in churn rate going from 9 validators/epoch to 10 validators/epoch once there are 10 * 65,536 = 655,360 validators. This will put more pressure on reducing the queue.

An epoch is 6.4 minutes long which means there are 225 epochs in a day. At 9 validators per epoch, Ethereum can activate 2025 validators or 64,800 ETH per day. At 10 validators per epoch, that grows to 2250 validators or 72,000 ETH per day.

Implications of an Activation Queue

While the churn limit ensures the stability of Ethereum’s validator set, the corresponding long activation queue has other consequences:

Boosting the growth of Liquid Staking Derivatives (LSDs): LSDs already allow investors to access the risk-free rate of ETH validation rewards without the complexities of running a validator. By distributing the inefficiency of inactive validators across their entire validator set, LSDs also enable investors to start earning yield immediately while their associated ETH validator moves through the queue. A solo staker does not have this advantage.

Stifling innovation and growth among new LSDs: A new LSD starting out with a month-long wait queue has no active validators earning yield to offset inactive validators and therefore is at a disadvantage to large incumbents like Lido. This is what has stifled the short-term APR of fast-growing LSDs such as Frax Finance $sfrxETH and Rocket Pool $rETH. It is also why nascent LSD protocol Swell has to subsidize incentives on the backend in order to bootstrap adoption. This is not an option for smaller protocols without a large treasury.

Based on this, I think we will see increasing innovation and growth of smaller players as the activation queue collapses.

Current Activation Queue

After two months of increasing, in early June the activation queue began to flatten out, now 4 days shorter than its all-time high of 48 days. In a couple days, the churn limit will increase again putting more pressure on decreasing the queue.

ETH Staking Rate

In addition to churn limit increasing, the more significant factor that drives the activation queue length is how much ETH is being staked every day. After some initial turbulence from withdrawals, staked ETH surpassed 100k ETH/day for almost a month. Since then, staked ETH rate has settled to under 50k ETH/day.

Predicting the End of the Activation Queue

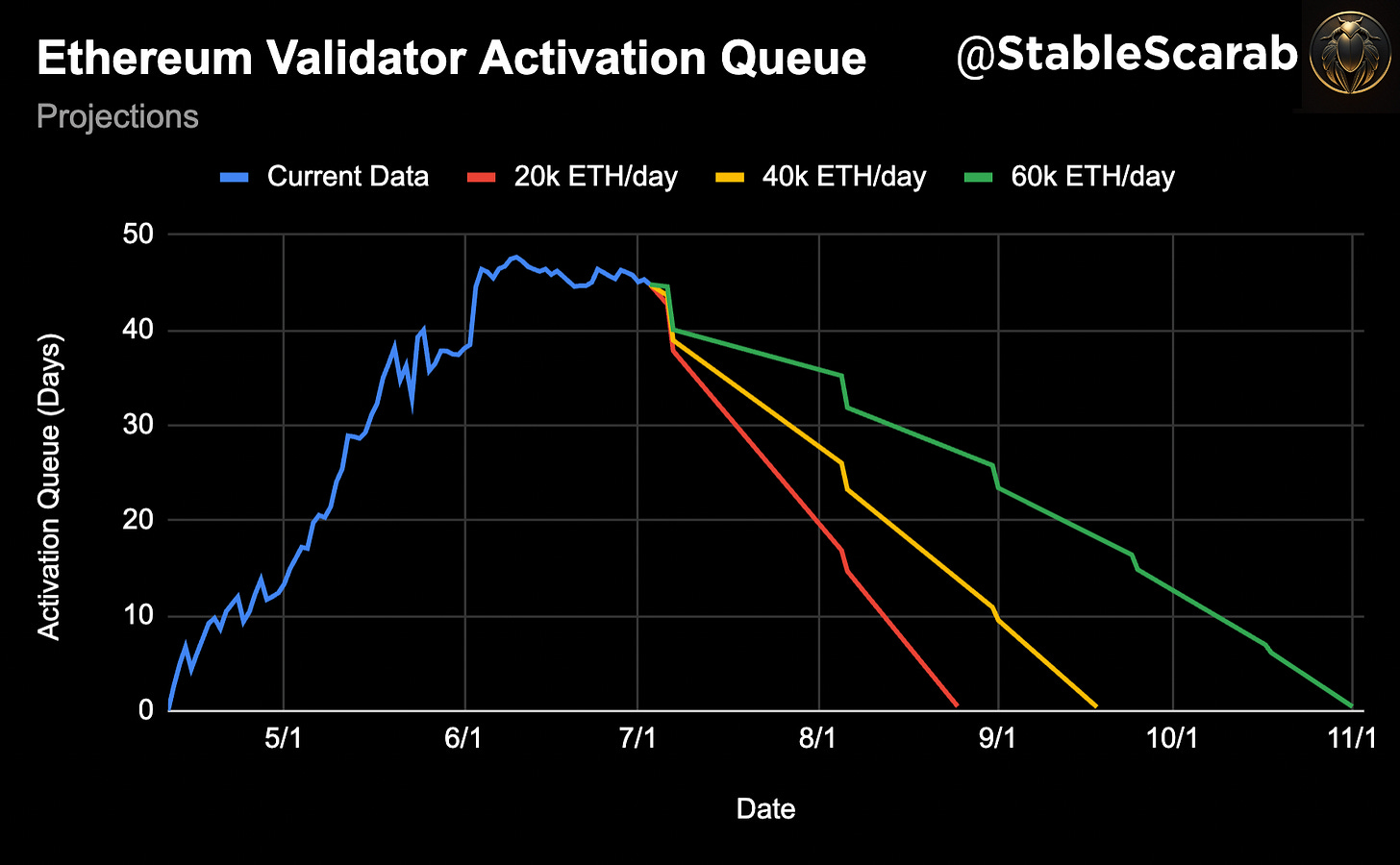

The end of the activation queue is dependent on the rate at which ETH continues to be staked. Let’s take 40k ETH staked per day as our base case, 60k ETH/day as our upper bound, and 20k ETH/day as our lower bound.

When would the activation queue reach zero?

Increase in staking rate case, 60k ETH/day: Nov 1

Base level staking rate case, 40k ETH/day: Sep 18

Decrease in staking rate case, 20k ETH/day: Aug 25

Impact on the LSD Market

Frax Finance $sfrxETH which has the highest APR already at ~5% will continue to maintain its lead. Rocket Pool $rETH stands to gain the most from the end of the activation queue, as ~20% of their validators are currently pending. Despite being the incumbent, even Lido has 10% of their validators pending. Lido’s post-Shapella growth has exceeded my expectations, but I’m looking forward to smaller players continuing to gain market share.

Conclusion

The post-Shapella growth of staked ETH has been impressive, resulting in a long activation queue. However, the increasing churn limit and decreasing staking rate suggest that the activation queue will likely be eliminated by the end of summer. This will benefit newer LSDs whose validators have been held up in the queue. Removing the activation queue will level the playing field, allowing us to explore other factors that contribute to LSD adoption. Over the coming posts, I will explain in more detail what it takes to win the LSD market and who I think will come out on top.